Is a Curtain a Fixed Asset?

A curtain is not a fixed asset. A fixed asset is something that is owned and used for a long time, such as a house, a car, or a machine. Curtains are more like a piece of clothing or a decoration, which are not fixed assets. They are often used to block light or provide privacy in a room. When no longer needed, they can be easily taken down and replaced with new ones. Therefore, curtains are not fixed assets, but rather a part of the home decoration or furnishing.

In the world of accounting and finance, there are specific definitions and classifications for assets that determine whether or not they are considered fixed. Fixed assets, also known as tangible assets or long-term assets, are those that are expected to provide economic benefits for more than one year. They are typically recorded on the balance sheet of a company as major investments that contribute to the overall value of the business.

Now, let’s turn our attention to a common household item: the curtain. When it comes to accounting for a company’s assets, the question arises as to whether a curtain can be classified as a fixed asset. To answer this question, we need to consider the nature of curtains and how they are used in businesses.

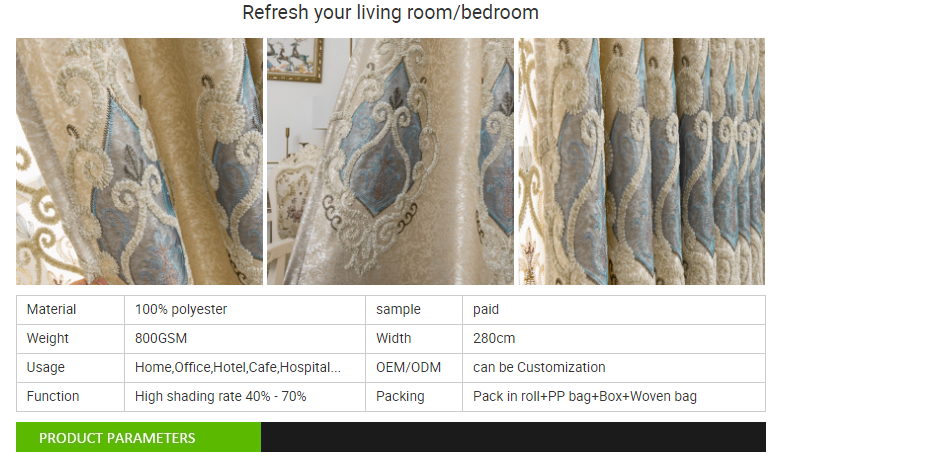

Firstly, curtains are primarily used to provide privacy, block light, or enhance the appearance of a room. They are generally considered to be part of the interior decoration of a building. As such, their value is often tied to their aesthetic appeal and functionality, rather than their cost or how long they last.

When it comes to businesses, curtains may be considered a part of the fixed assets if they are being used in a commercial environment where their purpose is to provide privacy or enhance the overall look of the premises. For example, if a company rents out office space and installs curtains to divide workspaces or create private offices, those curtains could be considered fixed assets. This is because they are being used in a way that provides economic benefits to the business over the long-term.

However, if curtains are being used solely for decorative purposes in a business environment, their classification as a fixed asset may not be as clear-cut. This is because their value may not directly contribute to the company’s economic benefits or provide long-term returns on investment. In such cases, curtains may be considered an integral part of the company’s interior design and may not necessarily fall under the category of fixed assets.

Moreover, when it comes to individuals or households, the classification of curtains as a fixed asset becomes even less relevant. Curtains in private residences are primarily purchased for their decorative value and functionality, rather than as an investment that will provide long-term economic benefits. Therefore, from an accounting perspective, they are not typically treated as fixed assets but rather as personal items or household decorations.

In conclusion, while curtains in some cases can be classified as fixed assets in businesses (especially when they are being used for commercial purposes), their classification as such is not always straightforward. The key factor is their intended purpose and how they contribute to the overall value of the business or individual homeowner. In most instances, curtains are viewed more as a personal item or decoration rather than as an investment with long-term economic benefits.

Articles related to the knowledge points of this article:

Womens Short-款 Winter Coat: Fashion and Functionality

Title: The Evolution of Wedding Ties: From Bow Ties to Suit Ties

Title: How to Determine the Appropriate Location for a Tie

The rise of womens down jackets: exploring the top brands in the industry